Closing the books at the end of a financial period is crucial for any enterprise. Many still use manual processes and separate systems, leading to delays and errors. This is where ERP system integration comes in.

ERP systems make closing the books faster, more accurate, and more efficient, easing the workload for finance teams.

What Is ERP System Integration?

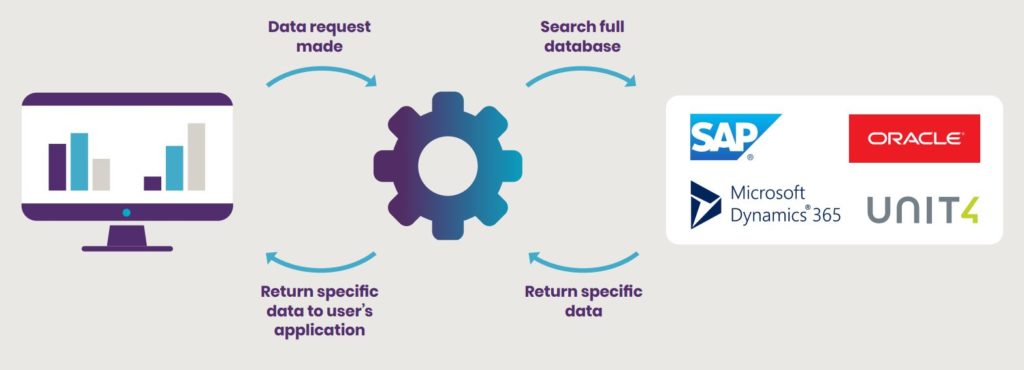

ERP system integration links your ERP platform to other enterprise systems and data sources. Companies create a unified system where information flows smoothly across departments. Integration removes data silos and reduces manual entry. It also helps decision-making by providing better data insights.

ERP system integration gathers and merges key financial and operational data, providing instant access to this information. Enterprises then can achieve faster, more efficient financial close cycles.

Types of ERP Integration

ERP system integration has a few types, depending on the needs and technological infrastructure of an enterprise:

- Point-to-Point Integration: Directly connects two systems but can become complex as more connections are added.

- Enterprise Service Bus (ESB) Integration: Uses a centralised bus to manage multiple system connections.

- API-Based Integration: Takes advantage of APIs to enable data sharing between systems, offering flexibility and scalability.

API or live integration

The right type of integration can be chosen depending on the existing infrastructure as well as long-term goals.

The Challenges of Financial Close

There are several challenges that a financial close process can have for many enterprises. These complications extend closing periods, cause errors, and increase workloads for finance teams. Common issues are:

- Manual Data Entry: Relying on spreadsheets and manual processes increases the risk of errors and inefficiencies.

- Data Silos: Disconnected systems across departments make it hard to consolidate financial data.

- Limited Visibility: The lack of real-time insights hinders effective decision-making.

- Time-Consuming Reconciliation: Matching transactions across systems is labour-intensive and error-prone.

- Compliance and Audit Challenges: Without proper controls, managing audit trails and regulatory compliance becomes difficult.

These challenges show that enterprises need an integrated solution that simplifies the entire financial process.

How ERP System Integration Improves the Financial Close Process

Finance teams often find the financial close process stressful. Traditional methods are slow and often inaccurate. ERP system integration offers practical solutions that simplify many aspects of the process.

The financial close process has its cons, such as manual data entry, reconciliation issues, and limited visibility into organisational finances. Fortunately, this system integration solves these common problems. Let’s see how integration addresses these pain points.

Automated Data Collection and Consolidation

ERP system integration automatically collects financial data from various sources. It then consolidates this information into a unified system. The system collects data from all departments. It then combines this information in a central database.

Automation in ERP systems significantly reduces repetitive data entry tasks. This shift allows finance professionals to dedicate more time to high-value activities like in-depth analysis and comprehensive reporting.

Real-time Visibility Into Financial Data

Integrated Enterprise Resource Planning (ERP) systems have transformed financial management by providing instantaneous data visibility. Integrated ERP platforms give finance professionals instant access to detailed financial data. This allows for constant monitoring of all fiscal activities. As a result, potential issues or irregularities can be spotted immediately.

The profound benefit of such systems lies in their ability to support proactive decision-making. Finance teams can now swiftly identify potential issues before they escalate, make data-driven strategic choices, and maintain enhanced transparency across financial operations. This approach shifts organisations from reactive reporting to a dynamic, predictive financial management model, where minor discrepancies can be caught and addressed immediately, ultimately reducing financial risks and improving overall organisational financial health.

Real-time insights from integrated ERP systems enable leadership teams to act proactively. This improved decision-making capability enhances overall financial management in the long run.

Improved Accuracy and Reduction of Errors

Manual processes are prone to errors, whether we like it or not. Integrating ERP systems allows enterprises to reduce data entry errors and enhance overall accuracy. Automated validations and reconciliations then enhance data integrity, leading to more reliable financial reporting.

Error reduction is especially important when dealing with high transaction volumes because small discrepancies can lead to significant issues.

Faster Reporting

ERP system integration simplifies financial reporting by automating report generation and consolidating data. This speeds up the closing process. It also provides stakeholders with quick and precise financial updates. Faster reporting enables organisations to improve decision-making and enhance strategic planning.

Companies that can produce reports faster are in a stronger position to adapt to market shifts and meet regulatory demands.

Benefits of ERP Integration for Financial Close

Integrating ERP systems provides practical advantages that can reshape financial operations. The ERP integration has a lot of benefits, which can be seen below.

Understanding the benefits of ERP system integration can shed light on how it transforms the financial close process. Let's explore these advantages in detail:

Reduced Close Cycle Time

A key benefit of ERP integration is reducing close cycle time. Automating routine tasks allows finance teams to close the books more quickly. Real-time data access further enhances efficiency. This allows teams to focus more on strategic activities and less on mundane administrative tasks.

Shorter close cycles also free up resources, enabling organisations to allocate time and effort to growth initiatives.

Better Compliance and Audit Trails

Integrated ERP systems offer built-in controls and automated audit trails. These features make it easier to maintain compliance with financial regulations. Comprehensive tracking and documentation also reduce the effort needed for audits and enhance transparency.

Accurate financial records help organisations demonstrate compliance with industry standards and legal requirements.

Cost Savings Through Automation

Automating financial close processes with ERP integration reduces the need for manual labour, lowering operational costs. This shift also improves accuracy and efficiency, helping prevent costly errors and penalties. As a result, the cost savings grow significantly over time, adding substantial value to the organisation.

Cost savings extend past immediate financial gains. Streamlined processes improve long-term operational efficiency. This enhances productivity and sustainability.

Enhanced Collaboration Across Departments

ERP system integration improves collaboration by offering a single source of financial data. Centralised data improves communication and reduces delays. Teams can make better decisions and work together more effectively with accurate, current information.

ERP platforms provide collaborative tools for real-time communication and easy data sharing. These features help teams stay connected and work together smoothly, no matter their location or department. ERP integration improves coordination by streamlining information flow. This boosts productivity and reduces bottlenecks.

Scalability and Flexibility

When financial processes become more complex, integrated ERP systems can scale to handle more transactions and changing needs. This scalability ensures that the financial close process remains efficient even as the organisation expands.

Flexibility in system configuration allows companies to adapt their processes without significant disruptions.

Conclusion

ERP system integration offers a transformative solution for organisations looking to improve their financial close process. Automating data collection, providing real-time insights, and accelerating reporting all offer clear advantages. ERP systems help enterprises reduce close cycle times and improve compliance. They also bring significant cost savings. This integration streamlines operations. It allows finance teams to focus more on strategic contributions to the organisation's success.

ERP system integration enhances collaboration, scalability, and automation, making it a key step towards modern financial management. It boosts efficiency and supports better decision-making.

Sounds interesting?

Frequently Asked Questions

What is a fully integrated ERP system?

A fully integrated ERP system connects all enterprise processes and departments in one unified platform, allowing real-time data sharing and streamlined operations across the organisation.

What is an example of ERP integration?

An example of ERP integration is connecting an ERP system with a CRM platform to synchronise customer data, sales orders, and service interactions seamlessly across departments.

What is SAP ERP integration?

SAP ERP integration involves connecting SAP's enterprise resource planning software with other applications to enable seamless data exchange and process automation across the organisation.